Introduction

The term “cash flow underwriting” isn’t new in the commercial banking space, but it has recently stepped into the fintech spotlight as open banking makes it easier than ever to securely access verified deposit data. For decades, banks have relied on traditional underwriting — analyzing financial statements, tax returns, and bureau data — to make credit decisions. While these tools remain useful, they often leave blind spots. Cash flow underwriting fills a lot of those gaps, providing real‑time insights into a business’s liquidity and payment behavior that static reports can’t match. When layered with traditional methods, it gives lenders a more comprehensive, real‑time view of creditworthiness, enabling faster, more precise decisions.

In this post:

- Why cash flow underwriting outperforms traditional commercial credit models

- How verified deposit data accelerates decisions and reduces fraud

- The role of AI in dynamic, real-time portfolio management

- How Torpago’s core integrations beat Plaid — in cost, control, and compliance

1. From Static to Dynamic: The Rise of Cash Flow Underwriting

Cash flow underwriting is the practice of using verified deposit data, sourced directly from a consumer or business bank account, to make smarter, data‑driven credit decisions. Because this data reflects actual transactions, it’s nearly impossible to manipulate and reveals insights that traditional models often miss.

Limitations of Traditional Commercial Underwriting

- Lagging signals – Delinquencies often aren’t reported until 30 days past due, and can take 60+ days to impact a credit score — if they’re reported at all.

- Debt‑centered scoring – Legacy credit scores focus narrowly on outstanding accounts, balances, and payment history, overlooking broader indicators of business health.

- Static, self‑reported data – Financial statements can show income and liquidity, but they’re often outdated, unaudited, or difficult to verify — making them far less useful for real‑time credit decisions.

By layering cash flow insights on top of traditional methods, lenders gain a more comprehensive, real‑time view of a borrower’s financial health — enabling faster decisions, smarter credit limits, and stronger risk management.

2. Turning Cash Flow Insights into Lending Opportunities

Cash flow underwriting offers more than improved approvals,it enables new ways to grow portfolios, manage risk, and strengthen relationships. Shifting from static, historical data to verified, real‑time account information creates opportunities in three key areas:

Faster, More Accurate Approvals — with Built‑In Fraud and KYB Benefits

- Verified deposit data accelerates decisioning from days to seconds.

- Transaction patterns help confirm a business’ size and legitimacy, showing cash inflow amounts from legitimate sources.

- Strengthens Know Your Business (KYB) processes and reduces fraud risk before accounts are opened.

Smarter Credit Limits from Day One — and Beyond

- Tailored to real liquidity and seasonal trends, limits accurately reflect true working capital needs.

- Dynamic adjustments allow limits to increase for growth or tighten for risk in real time.

- Avoids both over‑extension (credit risk) and under‑extension (missed opportunities).

Expanded Lending to Underserved Businesses

- Supports credit for businesses lacking deep credit histories or collateral.

- Enables growth in small business and emerging‑enterprise segments that traditional models often overlook.

Bottom line: Cash flow underwriting helps banks say “yes” more often, with more confidence — particularly in the competitive commercial card market.

3. AI‑Enhanced Cash Flow Underwriting

On its own, cash flow underwriting is powerful. Combined with AI and machine learning, it becomes a continuously adapting credit management system.

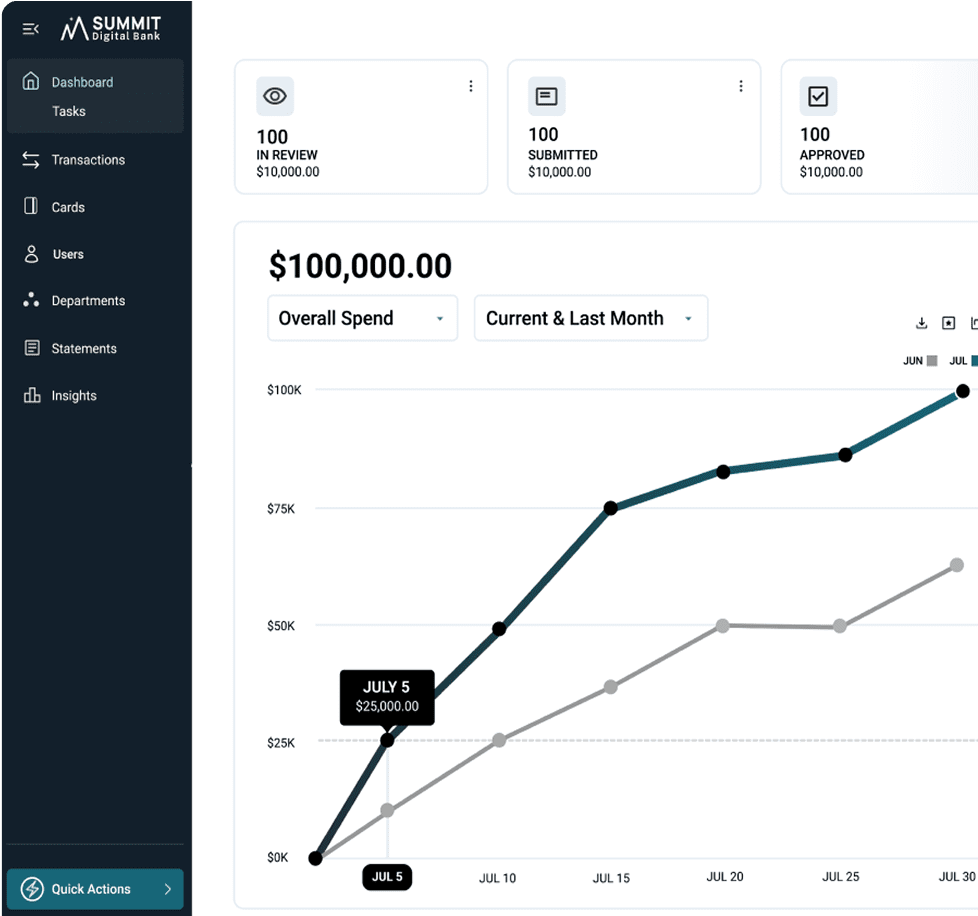

Continuous Credit Monitoring

- Tracks verified transaction data in real time to detect emerging risk or growth opportunities.

Proactive Limit Adjustments — Fully Documented

- Dynamically increases or reduces limits as cash flow changes.

- Automatically generates adverse action notices when limits are reduced or credit is declined.

- Drafts credit approval memos for review when increases are warranted.

Enhanced Fraud and KYB Protection

- Detects suspicious transaction patterns missed by human review.

- Drafts Unusual Activity Reports (UARs) and Suspicious Activity Reports (SARs) for compliance review.

Portfolio‑Level Intelligence

- Identifies trends to refine underwriting policies and find growth opportunities.

- Informs capital reserve planning based on real‑time portfolio risk.

AI turns cash flow underwriting into a living, breathing portfolio management tool — keeping credit strategies aligned with both opportunity and risk from day one and beyond.

4. Risks, Headlines, and Regulatory Watchpoints

The CFPB’s Open Banking Rule: Uncertainty, But Momentum Remains

The CFPB’s 2024 open banking rule — issued under Section 1033 of the Dodd‑Frank Act — was designed to ensure consumers, and potentially small businesses, could securely access and share their financial data at no cost.

In mid‑2025, the CFPB vacated the original rule and began a revised rulemaking process. While the updated version is expected to preserve core principles like permissioned access, data portability, and security standards, it will address concerns raised by both banks and data aggregators.

Despite uncertainty, momentum toward open banking remains strong. Banks, fintechs, and credit platforms continue investing in secure, customer‑authorized data‑sharing infrastructure — driven by competitive pressure and rising customer expectations.

What This Means for Commercial Credit

- Faster approvals based on live financial behavior.

- Smarter limit sizing tied to actual cash capacity.

- Proactive credit offers through ongoing monitoring.

- Lower fraud risk via real‑time identity and activity verification.

If access becomes restricted — through closed platforms or high fees — underwriting will regress to slower, less dynamic methods, limiting credit availability for qualified businesses.

5. How Torpago Bridges the Gap Between Theory and Portfolio Performance

Torpago combines verified deposit data, commercial card‑specific scoring models, and AI‑driven automation to deliver:

- Secure data access via open banking integrations.

- Proprietary cash flow scores built on real‑world commercial card performance.

- Automated approval memos, adverse action notices, and limit adjustments.

- Fraud and KYB monitoring with regulatory‑ready reporting.

- Portfolio insights to optimize growth, risk, and capital reserves.

Torpago’s AI doesn’t just monitor balances. It predicts liquidity drops before they happen, clusters high-risk behavior patterns across merchant types, and flags unusual changes in receivables velocity. By integrating these capabilities, Torpago turns cash flow underwriting from a one‑time approval process into an ongoing competitive advantage.

6. Verified Core Data — Without the Aggregator Fees

While Plaid and other aggregators have made it easier for fintechs to access deposit data, they come with trade‑offs: per‑connection fees, potential data reliability issues, and reliance on third‑party infrastructure outside the bank’s direct control.

Torpago takes a different approach — leveraging direct core integrations to provide the same (or better) verified, transaction‑level data without the middleman. This delivers clear advantages for both banks and their customers:

Lower Cost, Higher Certainty

- No Per‑Connection Fees – Avoid ongoing costs tied to aggregator‑based customer connections.

- Direct Access to the Source of Truth – Pull data directly from the core system of record, eliminating lags, stale data, or broken connections.

- Reduced Risk of Consent Fatigue – No repeated customer authentication through external aggregator UIs.

Better for Banks, Better for Borrowers

- Higher Data Fidelity – Core‑sourced deposit data captures the full picture of business activity, not just linked accounts.

- More Control & Compliance – Banks retain full visibility into what data is shared and how it’s used — critical in an evolving regulatory landscape.

- Stronger Relationships – Eliminating third‑party intermediaries strengthens trust and encourages direct customer engagement.

A Seamless Experience, Built‑In

For banks on supported cores, Torpago embeds this data access directly into the underwriting and portfolio management workflow — enabling cash flow underwriting and AI‑driven credit decisions without customers needing to “link accounts” or set up third‑party API keys.

In short: Why pay Plaid when your core can do the job better? Torpago brings the power of open banking in‑house — faster, cheaper, and fully bank‑owned.

7. The Bottom Line

- Cash flow underwriting is reshaping commercial credit.

- Open banking makes verified deposit data accessible.

- AI makes it dynamic and continuous.

Torpago makes it practical — delivering the tools, data, and automation banks need to grow portfolios with speed, confidence, and control.

About us

About us  News & press

News & press

Case studies

Case studies  Blog

Blog