All

-

2024 Community Banking Outlook – Trends and Takeaways You Need to Know

2024 Community Banking Outlook In October 2023, Torpago decided to evaluate the current mindset of…

Read more -

Why Every Bank Should Own Its Corporate Credit Card Program

Why Every Bank Should Own Its Corporate Credit Card Program

Read more -

Transform Your Bank’s ROI with Our Guide to Business Credit Card Programs

Unlock your bank’s potential with our guide to maximizing ROI through powerful business credit card programs. Download now to start driving growth!

Read more -

Why Your Bank Needs a Cutting-Edge Modern Stack Now

Embrace a cutting-edge tech stack, regain control, and outpace the competition with Torpago’s comprehensive program management for community banks.

Read more -

Business Card Underwriting: A Dynamic Solution to Reduce Risk

Revolutionize business credit with Torpago’s dynamic underwriting, leveraging cash flow and ongoing monitoring to expand access and reduce risk.

Read more -

How Business Credit Card Programs Can Serve as Fee Income Drivers

Boost revenue and enhance customer loyalty with business credit card programs, leveraging fee income, subscription models, and innovative technology solutions.

Read more -

CFPB Introduces New Data Requirements for Small Business Lending

CFPB mandates new data collection rules for small business lending to increase transparency, promote development, and combat discrimination.

Read more -

Three Tips for Building an SEO Foundation That Supports Your Business Credit Card Program and Your Institution’s Brand

Learn how to build a strong SEO foundation for your business credit card program and institution’s brand. Discover tips on title and header tags, local SEO, and customer reviews to enhance visibility and attract more customers.

Read more -

Torpago CEO Brent Jackson Talks With TechCrunch About Powered By

Learn about Torpago CEO Brent Jackson’s interview with TechCrunch, where he discusses the company’s shift towards white-label business credit card solutions and plans for utilizing AI in compliance and implementation.

Read more -

The Importance of a Nurture Process for Business Credit Card Programs

Maximize your business credit card program’s success with a strategic nurture process. Learn how to leverage email marketing to convert leads into customers and drive applications.

Read more -

Why Your Business Credit Card Needs a Distinctive Brand

Discover the importance of a distinctive brand for your business credit card. Learn how branding affects customer recognition, trust, differentiation, emotional connection, and purchase decisions.

Read more -

Tips for Making Direct Mail Campaigns More Successful at Driving Applications for Your Business Credit Card Program

Learn how to boost the success of your business credit card program with direct mail campaigns. Discover tips on targeting, converting, and supporting your mail efforts effectively.

Read more -

How Banks Can Use Affiliate Marketing to Acquire Business Credit Card Customers

Discover how banks can leverage affiliate marketing to acquire business credit card customers efficiently. Learn about the differences between influencer marketing and affiliate marketing, and how to manage an affiliate marketing program.

Read more -

Four Digital Marketing Must-Haves for Launching a Business Credit Card

A successful business credit card program launch requires campaigns across a wide range of digital channels.

Read more -

3 Key Digital Transformation Challenges Banks Should Account For

While technology-focused projects offer significant opportunities for growth and efficiency, banks are likely to encounter a range of challenges along the way.

Read more -

Three Tips for Launching Successful Influencer Marketing Campaigns for Business Banking Products

While influencer marketing is often seen as a B2C strategy, it can also be successfully leveraged for B2B products and brands as long as certain considerations are taken into account.

Read more -

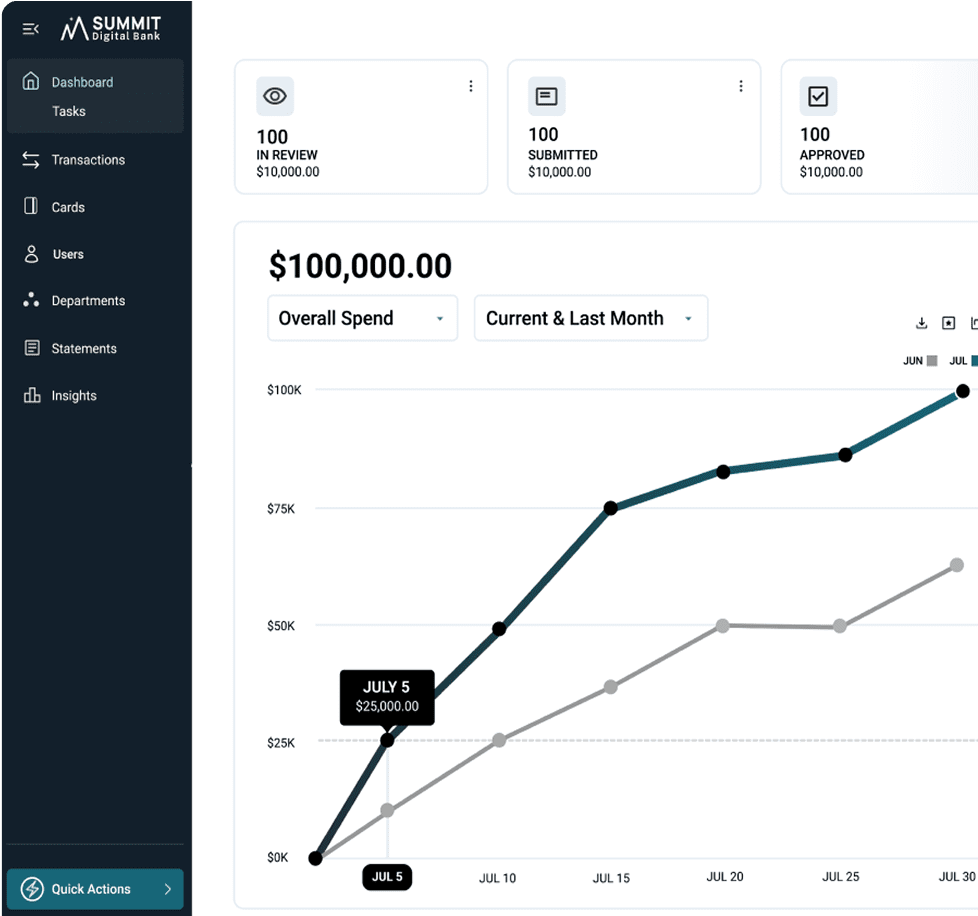

How Torpago Helps Banks Control Their Commercial Card Programs

Torpago’s Bank Admin Tool (‘BAT’) provides real-time data access and no-code controls that help banks make effective business decisions.

Read more -

Regulators are Focused on BaaS Banks. Should Your Bank Use a Different Partnership Model?

Why are BaaS banks facing so much regulatory scrutiny? Should your bank use a different model for the fintech partnerships needed to drive digital transformation?

Read more -

CFPB Caps Late Fees. What Does This Mean for Bank Credit Card Programs?

Given the significant reduction in fee limits, credit card issuers that generate significant revenue from late fees will see that line item drop substantially.

Read more -

Why Identity Verification is Critical for Credit Fraud Prevention

The financial service industry is less effective at detecting fraudulent applications and is more vulnerable to fraudulent activity by applicants.

Read more -

7 Reasons for Banks and Credit Unions to Partner with Torpago

Here are seven benefits of partnering with Torpago and leveraging our Powered By Solutions that can help you get quick competitive wins on the board.

Read more -

Torpago Powered By: Launching Sunwest Bank’s Business Credit Card Program

Community banks and credit unions have long been key to making finance more equitable and increasing the number of people who have access to financial services.

Read more -

The Importance of Credit Unions and Community Banks for Making Finance More Equitable

Community banks and credit unions have long been key to making finance more equitable and increasing the number of people who have access to financial services.

Read more -

Banks and Credit Unions: Is Your Credit Program Partner Offering Enough?

Banks and credit unions, this guide unlocks three crucial areas to evaluate fintech partners for long-term credit card program success.

Read more -

What is Embedded Banking and How Credit Unions Can Take Advantage

Embedded banking integrates banking services into non-financial digital platforms, offering a more efficient way to manage financial transactions.

Read more -

Three Tips for Improving Customer Experience Community Banks Should Leverage

There are opportunities that community banks can take advantage of to make themselves more competitive against larger banks and non-bank financial institutions alike.

Read more -

Track Torpago Down at These Events in Q1

Torpago is starting the year off strong with everything from conference attendances to co-hosting private parties. Here’s where you can find us in Q1!

Read more -

5 Major Themes in the Community Banking Landscape

Torpago’s top takeaways from our latest eBook, “2024 Community Banking Outlook,” which include the results of our community banker survey.

Read more -

5 Red Flags to Look for Among Business Credit Card Program Providers

Given the costs and challenges of setting up, maintaining, and upgrading business credit card programs, community banks and credit unions often turn to third-party program providers for help.

Read more -

Increasing Efficiency While Maintaining Effectiveness in Credit Underwriting | A Tale of Incorporating AI into Traditional Financial Processes

Torpago Director of Risk, Brendan Coons, shared how AI builds on the solid foundations of legacy institution processes to make underwriting and risk management faster and more efficient.

Read more -

Tight Credit Has Sent Small Business Shopping for Loans. How Community Banks Can Capitalize.

Small business owners that bank with big banks have to shop around for credit, creating an opportunity for community banks to win their business.

Read more -

Understanding the Bank Identification Number (BIN): A Vital Element for Starting a Credit Card Program

In addition to being critical for processing payment card transactions, BINs are also used for security purposes, such as identifying stolen cards and helping manage identity theft.

Read more -

Opportunities for Community Banks Amidst Turbulent Economic Waters

There are opportunities that community banks can take advantage of to make themselves more competitive against larger banks and non-bank financial institutions alike.

Read more -

Torpago Partners With Keep A Breast Foundation to Make Helping Women Easier

Torpago is pleased to announce a new partnership with Keep A Breast (KAB) Foundation, a nonprofit dedicated to breast cancer prevention and helping women affected by breast cancer.

Read more -

How Partnerships Between Banks and Fintechs are Changing Banking

Fintechs have taken advantage of the gaps between new customer expectations and the services available from their banks to build their own customer bases.

Read more -

Your Torpago Subscription Now Includes Assurant® Device Care

Torpagp has partnered with Assurant® to add Device Care as a benefit to customers, providing access to a complimentary nationwide repair service network.

Read more -

Torpago Head of Bank Partnerships James Yacobucci Discusses the Present and Future of Community Banking

James Yacobucci of Torpago discusses the role of community banks in the financial services landscape, the challenges, and strategies for growth.

Read more -

Torpago CEO Brent Jackson Joins Nasdaq Trade Talks to Discuss Future of Community Banks

Torpago CEO Brent Jackson made an appearance on Nasdaq Trade Talks to discuss the advantages community banks and credit unions have compared to larger banks.

Read more -

Benefits of Bank and Fintech Partnerships

Bank-fintech partnerships can be structured in any number of ways, be it as straightforward as the traditional client-vendor model or as involved in a strategic joint venture.

Read more -

Opportunities in Spending: Three Key Topics from the “Beyond the Norm: Building Loyalty with Expense Management and Corporate Cards” Webinar

The three main topics discussed in the Torpago and Marqeta webinar, “Beyond the Norm: Building Loyalty with Expense Management and Corporate Cards.”

Read more -

FedNow Brings Instant Payments to the Banking System

On Jul 20, 2023, the Federal Reserve launched FedNow, its instant payments service.

Read more -

Financial Awareness: A Key Ingredient for Venture-Funded Startups

There’s a concept startup founders and leaders need to be aware of that will help them make better financial decisions and manage financial risk: financial awareness.

Read more -

Torpago Product Updates | July-2023

The Torpago Team launched some exciting updates and fresh feature goodies for you! Are you ready to dive into the new and improved platform features?

Read more -

Financial Wellness for Startups: Avoiding Stress in a Challenging Fundraising Environment

Achieving financial wellness is more important for venture-funded startups than it ever has been.

Read more -

A Quick Look at Torpago CEO Brent Jackson’s Appearance on the Leaders in Payments Podcast

CEO Brent Jackson joined the Leaders in Payments Podcast and host Greg Myers to speak about Torpago, broader trends in fintech and financial services, and more.

Read more -

5 Spend Management Best Practices

5 spend management best practices that will help you get the most out of your spend management process.

Read more -

Top Takeaways from Torpago CEO Brent Jackson’s Appearance on the PayPod Podcast

Top takeaways from Torpago’s CEO, Brent Jackson, in an interview with Jacob Hollabaugh of PayPod: The Payments and Fintech Podcast.

Read more -

How to Create a Company Credit Card Policy

Before you issue corporate credit cards, it’s important to have a company credit card policy in place.

Read more -

Eliminate Expense Reimbursement Fraud

While discrepancies with expense reimbursements can sometimes be simple mistakes, expense reimbursement fraud happens more often than you might think.

Read more -

Stop Doing Expensive Reimbursement: There’s a Better Way

In addition to the impact on employees, companies also pay the price for processing employee expense reimbursements.

Read more -

6 Reasons Employees Hate Your Expense Reimbursement Process

Most employees are unhappy with the traditional business reimbursment process. Torpago provides a more modern way to handle expense management.

Read more -

![[New eBook] The Business Reimbursement Model Is Dying: Making the Transition from Expensive Reimbursement](data:image/svg+xml;base64,PHN2ZyB3aWR0aD0iMSIgaGVpZ2h0PSIxIiB4bWxucz0iaHR0cDovL3d3dy53My5vcmcvMjAwMC9zdmciPjwvc3ZnPg==)

[New eBook] The Business Reimbursement Model Is Dying: Making the Transition from Expensive Reimbursement

Download the eBook from Torpago: The Business Reimbursement Model Is Dying Making the Transition from Expensive Reimbursement.

Read more -

How to Choose a Bank for Your Business

Choosing a bank for your business is an important financial decision that requires careful consideration, and it is essential to do your own research.

Read more -

What is Spend Management and Why Does it Matter?

Spend management is the practice of tracking, analyzing, and controlling business expenditures. It helps organizations reduce costs and operate more efficiently, making it easier to identify cost savings opportunities.

Read more -

Feature Spotlight: Reimbursement Processing

Torpago includes reimbursement processing, enabling our customers to take advantage of our automation technology to handle reimbursement requests.

Read more -

![[Upcoming Webinar] Beyond the Norm: Building Loyalty with Expense Management and Corporate Cards](data:image/svg+xml;base64,PHN2ZyB3aWR0aD0iMSIgaGVpZ2h0PSIxIiB4bWxucz0iaHR0cDovL3d3dy53My5vcmcvMjAwMC9zdmciPjwvc3ZnPg==)

[Upcoming Webinar] Beyond the Norm: Building Loyalty with Expense Management and Corporate Cards

Register for the upcoming Marqeta webinar: Beyond the Norm: Building Loyalty with Expense Management and Corporate Cards

Read more -

3 Top Takeaways From Fintech Meetup 2023

Torpago’s three Top Takeaways from Fintech Meetup 2023.

Read more -

Join Torpago at FinTech Meetup – March 19-22, 2023

Torpago is not impacted by the Silicon Valley Bank situation and our products and services have not been impacted and remain available to all of our customers.

Read more -

Torpago Partners with Heron Data to 20x Underwriting Speed

Torpago partnered with Heron Data to empower our Credit team to maximize revenue and decrease losses by enriching banking data for our underwriting and portfolio management processes.

Read more -

Torpago is Not Impacted by the Silicon Valley Bank Situation

Torpago is not impacted by the Silicon Valley Bank situation and our products and services have not been impacted and remain available to all of our customers.

Read more -

What You Need to Know About Corporate Credit

[NEW EBOOK] What are the options for implementing or upgrading your business spend management software? Here’s what you need to know!

Read more -

Why Millennials and Gen Z Are Saying NO to Expensing Costs

Are your younger employees frequently paying out of pocked for work-related items? There are much better ways for you and your staff.

Read more -

Do You Know Your Business Credit Card Alternatives?

FinTech innovation has opened up opportunities for you to step away from traditional banking and take advantage of better controls and processes!

Read more -

Employees Sharing Corporate Credit Cards? Your company is at risk.

What are the true costs and risks when employees share company credit cards? And what are the alternatives to maintain control? We have answers!

Read more -

Cut Your Business’ Finances Some Slack

With our newly released integration – you can view recent transactions, request virtual cards, and contact our support team without leaving your Slack terminal.

Read more -

Two is Better Than One

Security is at the forefront of everything Torpago does. That is why we now grant the ability to enable two-factor authentication. This ensures the highest level of data protection and security for our users, and their information.

Read more -

Mobile App & Digital Wallets

By empowering your team to manage expenses on the go, you turn the process from reactive to proactive. Say goodbye to being blindsided by massive expense reports at the end of each month.

Read more -

Stack $, Not Receipts

Whether you’re an employee or an accountant, you can benefit from Torpago’s email intelligence because sophisticated expense policies require sophisticated management tools.

Read more

Ready to scale your credit card program?

Join the banks and businesses already experiencing results with Torpago. Book a demo and see how we help teams deliver growth, simpler integrations, and impact.

About us

About us  News & press

News & press

Case studies

Case studies  Blog

Blog

![[New eBook] The Business Reimbursement Model Is Dying: Making the Transition from Expensive Reimbursement](https://www.torpago.com/wp-content/uploads/Blog-Banner-image@3x.png)

![[Upcoming Webinar] Beyond the Norm: Building Loyalty with Expense Management and Corporate Cards](https://www.torpago.com/wp-content/uploads/Marqeta-Torpago-Webinar.png)